Two Sides of the Same Coin

Why July’s Market Feels So Split

July’s Denver real estate market is a study in contrasts. Inventory and days on market continue to edge upward, buyer activity has cooled, and yet prices are holding steady. It’s a reminder that there’s no single “market”—outcomes vary widely depending on price point, location, property type, and motivation. Someone upsizing for a growing household approaches the process very differently from a rate-watcher waiting for the perfect drop. Real estate remains hyperlocal, and each move tells its own story.

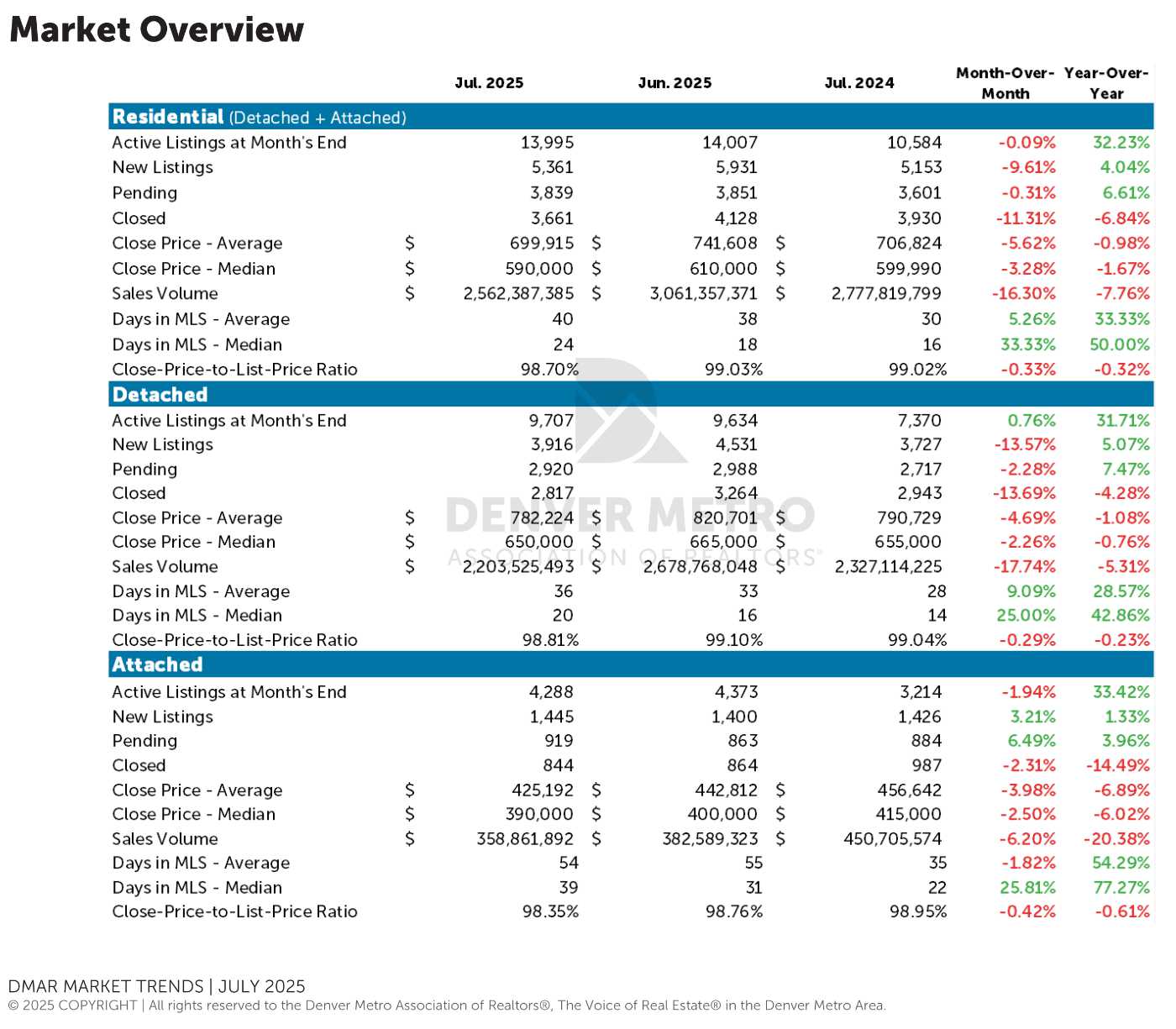

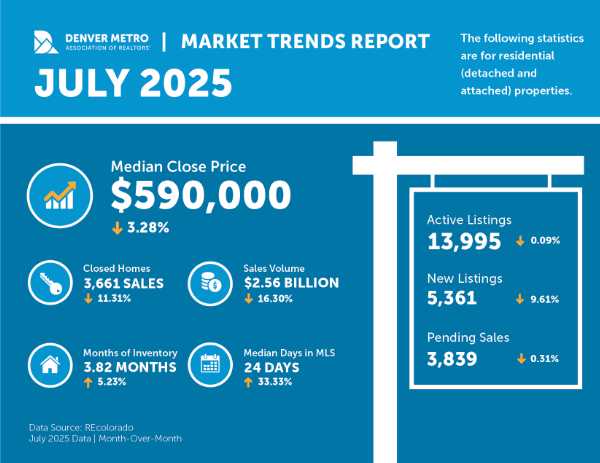

At the end of July, active listings reached 13,995—slightly below the long-term July average of 15,379. That’s a significant climb from the record-low 4,056 listings in 2021, but still nowhere near the 31,989 peak in 2006. Historically, inventory grows about 5.6 percent from June to July, but this year, it slipped by a fractional 0.09 percent, suggesting the seasonal high point may have already passed. In the attached market, conditions have tipped toward buyers with an average of 5.08 months of inventory across all price points. Withing that segment, Condos are facing a tougher road, with insurance and regulatory hurdles making sales more challenging.

At the end of July, active listings reached 13,995—slightly below the long-term July average of 15,379. That’s a significant climb from the record-low 4,056 listings in 2021, but still nowhere near the 31,989 peak in 2006. Historically, inventory grows about 5.6 percent from June to July, but this year, it slipped by a fractional 0.09 percent, suggesting the seasonal high point may have already passed. In the attached market, conditions have tipped toward buyers with an average of 5.08 months of inventory across all price points. Withing that segment, Condos are facing a tougher road, with insurance and regulatory hurdles making sales more challenging.

Homes are also taking longer to sell. The median days in MLS rose to 20 for detached properties and 39 for attached, up roughly 25 percent from June. On average, detached listings spent 36 days on market, while attached homes averaged 54. This slower pace reflects a buyer pool that has more choices, more time to compare, and higher expectations for condition and value.

Prices, meanwhile, have remained relatively stable. Detached homes closed in July at an average of $782,224, with a median of $650,000. Attached properties averaged $425,192, with a median of $390,000. Year-over-year price changes in the detached segment have been minimal, while attached homes saw slightly larger declines—just over 6 percent on the median and just under 7 percent on the average. Denver did lead the nation in June price reductions, with 37 percent of sellers lowering their list price, but even so, these shifts point more toward balance than a downturn.

Seasonal patterns are also at play. Summer often brings a dip in activity as vacations, outdoor recreation, and school breaks compete for attention. For buyers, this creates a unique opening: more inventory, less competition, and stable pricing give room for thoughtful decisions. For sellers, the challenge is making a strong first impression from day one. In today’s market, that means addressing condition issues, staging strategically, and pricing with both the competition and buyer expectations in mind.

For Sellers

Precision and adaptability are essential. While sales are down only 7.76 percent from last year and close-price-to-list-price ratios remain steady, the longer days on market mean buyers are moving at a more deliberate pace. Homes that are move-in ready and well-presented still sell faster. Sellers should prepare for a slower showing schedule, keep emotions in check, and have a clear plan for price adjustments if needed.

For Buyers

This is a market where preparation pays off. The combination of higher inventory, fewer bidding wars, and steady pricing offers a chance to secure the right home without feeling rushed. While a rate cut later this year is possible, buyers who are ready now can benefit from less competition and more negotiating power—especially on homes that have been sitting on the market for a while.

Every Situation is Unique!

July’s market isn’t telling one story—it’s telling many. Whether you’re buying, selling, or weighing your options, success comes from understanding the conditions that apply to your specific situation. Let’s connect and craft a strategy that puts you in the strongest position for your next move.

*We use reasonable efforts to include accurate and up-to-date information. The real estate market changes often. We make no guarantees of future real estate performance and assume no liability for any errors of omission in the content.